ReportLinker’s learning algorithm trained for MI provides market insights on the key players of the cannabis industry and its competitive environment.

- Which companies are spearheading the cannabis sector?

- What are the key objectives and focus of the company?

- What are the key indicators to watch?

With the legal global cannabis market expected to grow to $57 billion by 2027—as highlighted in the article, Discover New Market Insights with AI: Opportunities in the Cannabis Industry—astute investors with access to indepth insights can position themselves to capitalize on these new opportunities.

Market dynamics in a rapidly evolving industry

According to Bloomberg, “developments show that global receptiveness to marijuana is accelerating.”[2] Citing Mexico as an example, the media company says it took just 12 years to go from the decriminalization of the possession of small amounts of marijuana—also known as cannabis—in 2009, to the legalization of the drug for recreational use in 2021. In stark contrast, the USA started the process in the 1970s, legalized medical cannabis in the 1990s, but is still awaiting federal approval for nationwide recreational use some 50 years later.

With new markets opening up, the race to establish a dominant market position is on! With high-quality, low-cost manufacturing and the presence of multinationals, Mexico could quickly become a powerhouse for production and global distribution. But they’re not the only ones jockeying for a slice of the pie.

Curaleaf, the largest US-based multistate operator with a market capitalization of $11 billion, recently bought Emmac Life Sciences Ltd. for $285 million. The acquisition gives Curaleaf access to the EU market with an immediate presence in eight countries—thanks to Emmac’s legal status as a supplier of medical marijuana. Two days later—on March 11, 2021—British American Tobacco (BAT) Plc. announced the purchase of a 20% stake in Canada’s Organigram Holdings Inc. for $175 million. The collaboration gives BAT access to cannabis expertise and industry-leading product innovation, fueling the shift away from high-risk nicotine and tobacco products.

Identifying industry players spearheading the sector

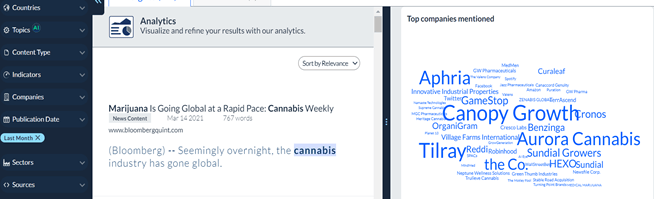

Leaders in cannabis innovation, production, and distribution can easily be spotted by keeping track of who has been in the news in recent weeks. Filtering by publication data (in this case, the last month), ReportLinker’s advanced AI-based analytics identifies companies mentioned in the traditional media, presenting them in the form of a scatter plot—with enhanced graphics for the easy identification of leaders and laggards.

Figure 1. ReportLinker Analytics identifies companies with the most mentions in the traditional media

Clicking on any name allows interested parties to discover all of the articles linked to the specific company and their relationship to the cannabis industry.

Drilling down for detailed investment information

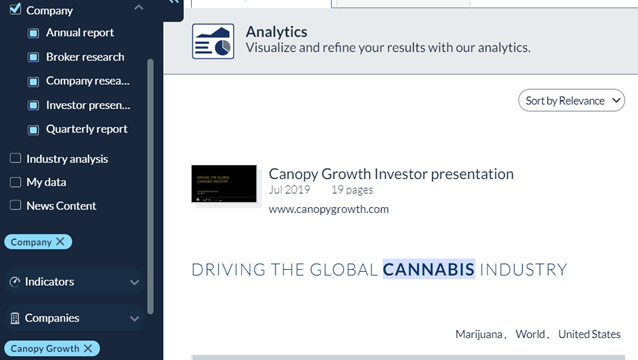

As indicated in Figure 1, Canopy Growth had the most mentions in the preceding month. Utilizing ReportLinker’s analytics capabilities provides access to Canopy Growth’s investment reports, identifying the key metrics related to its focus and future growth. To get the required information, simply check Company under Topics and search for Canopy Growth under Companies to get a list of relevant business reports.

Figure 2. Investment reports related to Canopy Growth

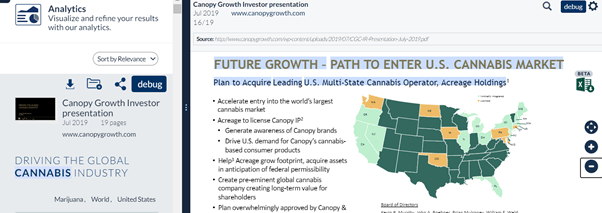

Figure 3 shows the Canopy Growth Investor presentation, using Natural Language Processing (NLP) to identify and highlight text related to the search criteria and filters chosen and displaying the relevant page. Built-in intelligence eliminates the need to browse the entire report to identify critical information. In this instance, the displayed page features Canopy Growth’s expansion strategy, including the planned acquisition of Acreage Holdings, a multistate US cannabis operator.

Figure 3. Canopy Growth’s expansion plans

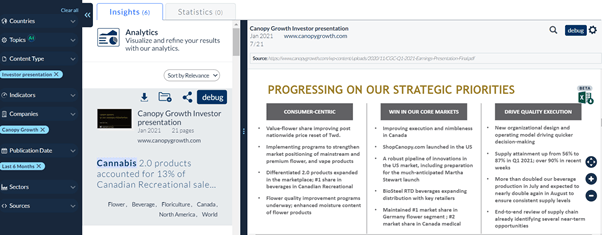

The page shown in Figure 4 depicts the company’s progress in realizing its strategic priorities—essential information for a discerning investor.

Figure 4. Canopy Growth’s strategic priorities

Evaluating the competitive environment

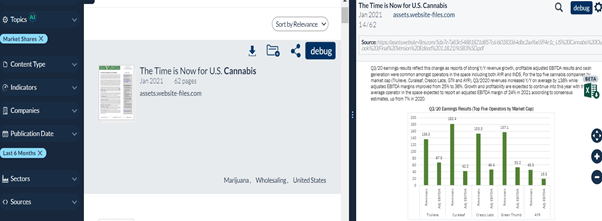

Once specific companies have been identified as potential investment opportunities, the next step is to evaluate the competitive environment using ReportLinker’s Smart Insights. As shown in Figure 5, choosing Market Shares under Topics and a publication date within the last six months provides details of the Q3/2020 earnings for the top five US operators based on market cap: Trulieve, Curaleaf, Cresco Labs, Green Thumb, and AYR.

Figure 5. The competitive environment in the cannabis sector

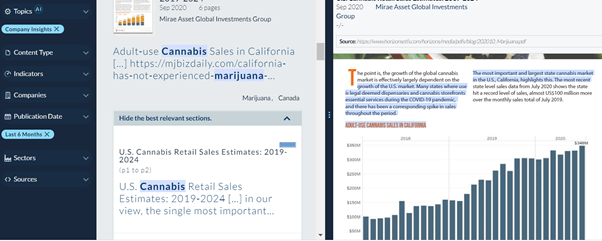

Utilizing ReportLinker’s innovative insight detection capabilities provides additional investor insights, including the demand for cannabis-based on historical sales (see Figure 6) and sales forecasts (see Figure 7).

Figure 6. Cannabis demand based on retail sales

Figure 7. US forecast for cannabis market growth

The bottom line

The cannabis market is ripe for investment. However, with rapidly evolving market dynamics and numerous industry players—local and foreign—battling to gain the upper hand, potential investors need to do their due diligence.

Pooling vast amounts of information and intelligent, AI-based search tools, ReportLinker delivers up-to-date, indepth insights for better, more-informed decision making.